Customized AML Compliance Program

QuickCheck offers a customized and comprehensive anti-money laundering program to keep you up to date with AML laws.

Take the worry out of AML compliance requirements with the best anti-money laundering software.

QuickCheck offers a customized and comprehensive anti-money laundering program to keep you up to date with AML laws.

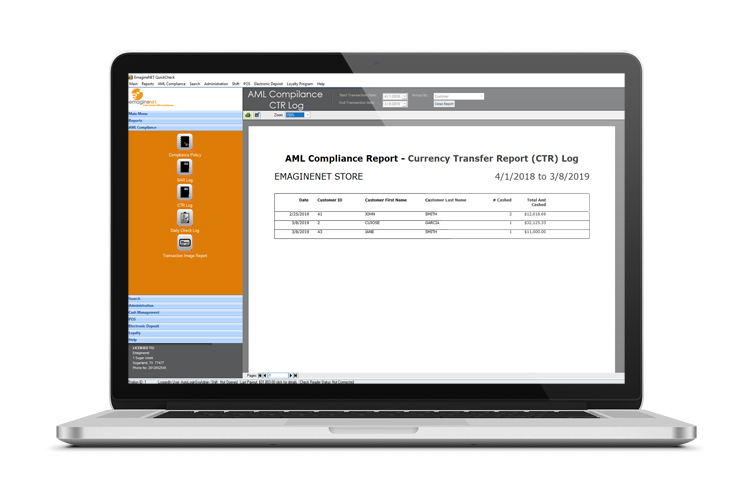

Auditors often require you to provide details of customers who cashed certain checks. QuickCheck anti-money laundering software retains all the necessary information electronically to help you stay compliant with the federal and state laws.

If a customer cashes more than $10,000 n checks in one day or a few equaling the same amount over the course of one month, you are required to report the transaction via a CTR or SAR form.

The Office of Foreign Asset Controls (OFAC) regularly publishes Specially Designated Nationals (SDN) List of individuals that are restricted from cashing a check or performing any MSB activities.

Pre-warnings to avoid exceeding CTR and SAR limits.

Main states require you to maintain certain to stay compliant with their regulations.